Stablecoin transaction volumes could surpass those of the United States Automated Clearing House system as early as 2026, according to a new forecast from Galaxy Research. The projection is based on current transaction data, supply growth trends, and expectations of clearer regulation for digital dollar instruments.

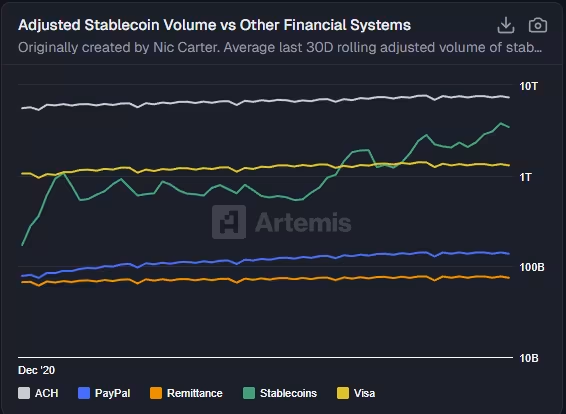

Galaxy Research said stablecoin transactions already process volumes comparable to the largest global payment networks. In its report, the firm noted that stablecoins now handle roughly half the transaction volume of the ACH system and already exceed major credit card networks such as Visa in onchain settlement value. The researchers argued that continued adoption by institutions, merchants, and financial platforms could push stablecoin usage beyond traditional payment rails within the next two years.

Thad Pinakiewicz, vice president of research at Galaxy, said stablecoin supply has been expanding at a compound annual growth rate of around 30 percent to 40 percent. He added that transaction volumes have risen alongside issuance, suggesting usage growth is not limited to speculative activity. Galaxy also highlighted the expected rollout of clearer legal definitions under the proposed GENIUS Act in early 2026 as a key factor that could accelerate adoption across regulated markets.

Regulation and institutional adoption drive stablecoin growth

Galaxy Research linked its stablecoin outlook closely to regulatory progress in the United States. The firm said clearer rules around issuance, reserves, and compliance could make stablecoins more attractive to banks, fintech firms, and payment providers seeking faster and lower cost settlement options.

The broader stablecoin market has already expanded significantly. Data from DefiLlama shows the total market capitalization of dollar pegged stablecoins stands at about $309 billion. Tether’s USDt and Circle’s USDC continue to dominate supply, but recent months have seen a growing number of traditional financial institutions and global brands entering the space.

Western Union announced in October that it plans to launch its own US dollar stablecoin, known as the US Dollar Payment Token. The token is expected to be built on the Solana blockchain and issued by Anchorage Digital Bank as part of a wider digital settlement network. Sony Bank has also been reported to be preparing a dollar pegged stablecoin for use across Sony’s US ecosystem, including PlayStation games, subscriptions, and anime content, with a potential launch planned for 2026.

On Thursday, SoFi Technologies introduced SoFiUSD, a fully reserved US dollar stablecoin issued by its banking subsidiary, SoFi Bank. The company said the token will initially launch on Ethereum and is designed to support low cost settlement for banks, fintech companies, and enterprise platforms.

Galaxy Research associate Jianing Wu said she expects consolidation among TradFi partnered stablecoins in 2026. She noted that merchants and users are unlikely to adopt a large number of digital dollars and will instead gravitate toward one or two stablecoin networks with the broadest acceptance and liquidity.

Beyond payments, the Galaxy paper also included a long term outlook for Bitcoin. The firm suggested Bitcoin could reach $250,000 by the end of 2027, while acknowledging that market conditions in 2026 are difficult to predict. According to Galaxy, the rapid growth of stablecoin infrastructure could play a supporting role in broader digital asset adoption by improving liquidity and settlement efficiency across crypto markets.

Read Also: Caroline Ellison faces decade-long director ban as SEC finalizes FTX-related judgments