Cryptocurrency has changed how people think about money, ownership, and financial systems. It is not just a new type of digital money. It represents a shift in how value can be created, stored, and transferred without relying on traditional banks or governments.

Over the past decade, cryptocurrency has moved from an experimental technology to a global financial asset class. Today, millions of people use digital currencies for investing, payments, remittances, decentralized finance, gaming, and digital ownership. Governments, banks, and corporations are also exploring blockchain-based systems, which shows that this technology is no longer on the fringe.

This guide explains cryptocurrency in clear and accurate terms. It covers how it works, why it matters, its risks, and how it fits into the future of global finance.

Understanding Cryptocurrency

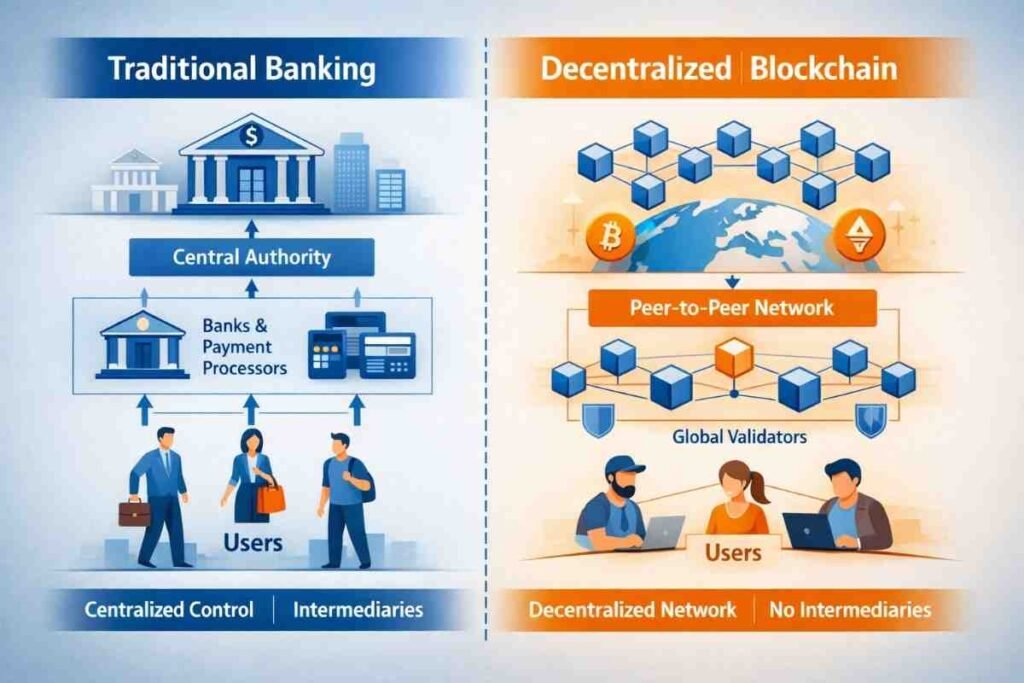

Cryptocurrency is a digital form of money that uses cryptography and blockchain technology to secure transactions and control the creation of new units. Unlike traditional currencies such as the US dollar or Indian rupee, cryptocurrency is not issued by a central authority like a government or central bank.

Instead, most cryptocurrencies operate on decentralized networks. These networks are maintained by thousands of computers around the world. Transactions are recorded on a public ledger called a blockchain, which ensures transparency and security.

Bitcoin, launched in 2009, was the first widely adopted cryptocurrency. It was created to offer an alternative to traditional financial systems, especially after the global financial crisis of 2008. Since then, thousands of cryptocurrencies have emerged, including Ethereum, Solana, Ripple, and many others.

Cryptocurrency differs from digital money in banks. Bank balances are controlled by financial institutions. Cryptocurrency allows individuals to hold and transfer value directly without intermediaries. This concept is often called self-custody.

From an economic perspective, cryptocurrency can function as a medium of exchange, a store of value, and in some cases a unit of account. However, its volatility means it is not yet widely used as a stable currency in everyday transactions.

How Cryptocurrency Works

At the core of cryptocurrency is blockchain technology. A blockchain is a distributed database that records transactions in blocks. Each block is linked to the previous one, creating a chain of data that is extremely difficult to alter.

When someone sends cryptocurrency, the transaction is broadcast to the network. Network participants, called nodes or miners or validators, verify the transaction using cryptographic algorithms. Once verified, the transaction is added to the blockchain.

Different cryptocurrencies use different consensus mechanisms to validate transactions. Bitcoin uses Proof of Work, where miners compete to solve complex mathematical problems. Ethereum has shifted to Proof of Stake, where validators lock up tokens to secure the network.

Cryptography plays a crucial role in security. Each user has a public key and a private key. The public key acts like an address, while the private key proves ownership of the funds. If someone loses their private key, they lose access to their cryptocurrency.

Smart contracts are another major innovation. These are self-executing programs stored on blockchains like Ethereum. They enable decentralized applications, including decentralized exchanges, lending platforms, and NFT marketplaces.

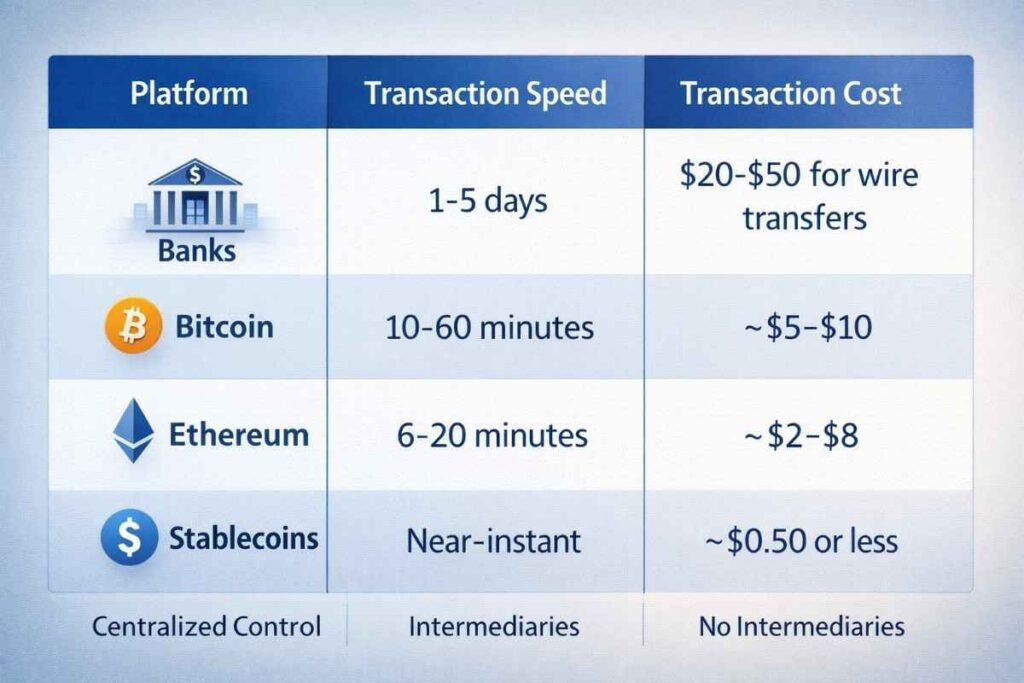

Cryptocurrency also enables peer-to-peer transactions across borders. Traditional international transfers can take days and involve high fees. Crypto transfers can occur within minutes, often at lower cost.

Why Cryptocurrency Matters

Cryptocurrency is not only a technological innovation. It has social, economic, and political implications.

One of the most important benefits is financial inclusion. Billions of people worldwide do not have access to traditional banking. With a smartphone and internet connection, they can use cryptocurrency to store and transfer value.

Another key factor is decentralization. Traditional financial systems rely on centralized institutions that can fail, censor transactions, or impose restrictions. Cryptocurrency networks are designed to operate without a single point of control.

Cryptocurrency also acts as a hedge against inflation in some countries. In regions with unstable currencies, people use digital assets to preserve value. Bitcoin is often compared to digital gold because of its limited supply of 21 million coins.

In the investment world, cryptocurrency has become a new asset class. Institutional investors, hedge funds, and publicly listed companies now hold digital assets. Crypto-based financial products such as ETFs have increased accessibility for mainstream investors.

Innovation is another major impact. Blockchain technology has led to new industries such as decentralized finance, Web3, gaming economies, and tokenized assets. These developments are reshaping how digital economies operate.

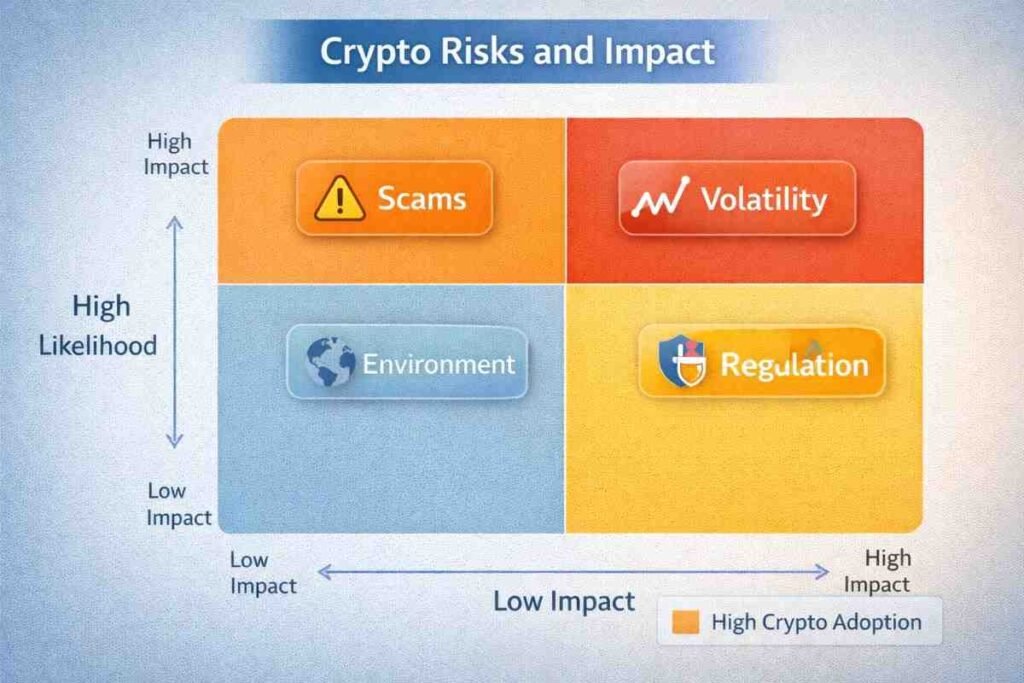

However, cryptocurrency also faces criticism. Price volatility, regulatory uncertainty, scams, and environmental concerns are major challenges. Governments are still developing frameworks to regulate digital assets without stifling innovation.

Risks and Challenges of Cryptocurrency

Despite its potential, cryptocurrency is not risk-free.

Volatility is the most visible risk. Prices of digital assets can rise or fall sharply within short periods. This makes cryptocurrency attractive for traders but risky for long-term stability.

Security risks also exist. While blockchain networks are secure, exchanges and wallets can be hacked. Users who do not follow proper security practices may lose funds.

Regulation is another uncertainty. Different countries treat cryptocurrency differently. Some have embraced it, while others have imposed restrictions or bans. Regulatory changes can significantly affect market prices and adoption.

Scams and misinformation are widespread in the crypto industry. Fake projects, pump-and-dump schemes, and phishing attacks have caused significant losses. Education and due diligence are essential for anyone entering this space.

Environmental concerns have also been raised, especially about energy-intensive mining processes. However, newer blockchain networks are adopting more energy-efficient models.

Understanding these risks is crucial before using or investing in cryptocurrency.

The Future of Cryptocurrency

The future of cryptocurrency is still evolving.

Many experts believe that blockchain technology will become a core infrastructure for digital finance. Central banks are exploring digital currencies, known as CBDCs, which are inspired by crypto concepts but controlled by governments.

Tokenization of real-world assets is another emerging trend. Real estate, stocks, bonds, and commodities can be represented as digital tokens on blockchains. This could increase liquidity and accessibility in global markets.

Decentralized finance continues to grow, offering alternatives to traditional banking services. At the same time, regulatory frameworks are becoming more structured, which could bring greater stability and institutional adoption.

Cryptocurrency is unlikely to replace traditional money entirely in the near future. Instead, it may coexist with existing financial systems, creating a hybrid global economy.

For individuals, understanding cryptocurrency is becoming increasingly important. Whether as a technology, an investment, or a financial tool, it is shaping the future of money.

Conclusion

Cryptocurrency represents one of the most significant financial innovations of the 21st century. It combines cryptography, blockchain technology, and decentralized networks to create a new way of transferring and storing value.

While it offers opportunities in finance, technology, and global inclusion, it also carries risks that require careful understanding. As adoption grows and regulations evolve, cryptocurrency will continue to influence how the world perceives money and digital ownership.

For beginners and investors alike, learning the fundamentals of cryptocurrency is no longer optional. It is a necessary step toward understanding the future of the digital economy.

Read Also: What is Bitcoin?