Ethereum is one of the most influential technologies in the digital economy. It is not just a cryptocurrency but a global decentralized platform that powers smart contracts, decentralized applications, and digital assets. While Bitcoin introduced the idea of digital money, Ethereum expanded the concept by enabling programmable blockchain technology.

Understanding what Ethereum is, how it works, and why it matters is essential for anyone exploring blockchain, crypto, Web3, or digital finance. This guide explains Ethereum in a clear and accurate way, based on real-world facts and verified information.

What is Ethereum and how it works

Ethereum is a decentralized blockchain platform that allows developers to build and run applications without relying on centralized servers or authorities. It was proposed in 2013 by Vitalik Buterin and launched in 2015 by a group of developers including Gavin Wood, Joseph Lubin, and others.

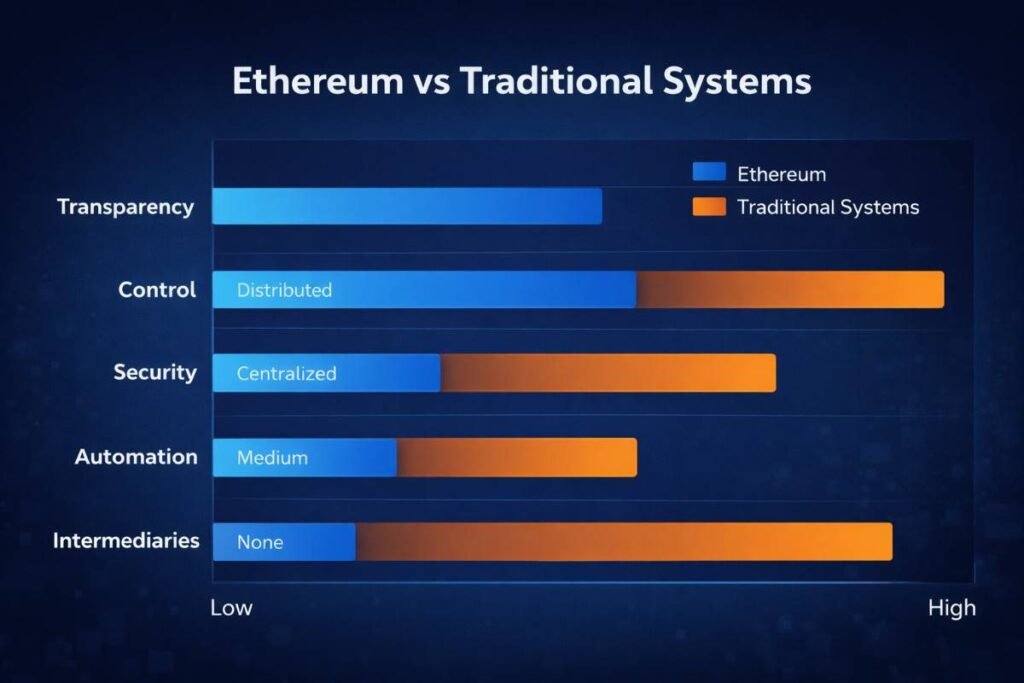

At its core, Ethereum is a distributed network of computers called nodes. These nodes maintain a shared ledger known as the blockchain. Unlike traditional systems where a central organization controls data, Ethereum operates through consensus among thousands of independent participants.

The native cryptocurrency of Ethereum is Ether (ETH). Ether is used to pay transaction fees, execute smart contracts, and secure the network.

Smart contracts

One of the most important innovations of Ethereum is smart contracts. A smart contract is a program stored on the blockchain that automatically executes when predefined conditions are met.

For example, a smart contract can release payment when goods are delivered, distribute tokens to investors, or manage digital identities. Because smart contracts run on the blockchain, they are transparent, tamper-resistant, and do not require intermediaries.

Ethereum Virtual Machine (EVM)

Ethereum runs smart contracts through the Ethereum Virtual Machine, also known as the EVM. The EVM is a global computing environment that executes code in a decentralized way. Developers can write smart contracts using programming languages like Solidity and deploy them on Ethereum.

Also Read: Layer 2 Explained: The Highway System Making Blockchain Actually Work

Consensus mechanism

Ethereum originally used Proof of Work, similar to Bitcoin. In 2022, Ethereum transitioned to Proof of Stake through an upgrade known as the Merge. Under Proof of Stake, validators secure the network by staking ETH instead of using energy-intensive mining.

This shift significantly reduced Ethereum’s energy consumption and improved scalability potential.

Real-world uses of Ethereum

Ethereum has become the foundation of many digital innovations.

Decentralized finance (DeFi)

Ethereum powers DeFi platforms that offer lending, borrowing, trading, and yield generation without traditional banks.

Non-fungible tokens (NFTs)

NFTs representing digital art, collectibles, gaming assets, and intellectual property are often built on Ethereum.

Decentralized applications (dApps)

Thousands of applications run on Ethereum, including games, social networks, marketplaces, and financial tools.

Stablecoins

Major stablecoins like USDT and USDC operate on Ethereum, enabling digital dollars on the blockchain.

DAOs

Decentralized autonomous organizations use Ethereum smart contracts to govern communities and projects.

Enterprise blockchain

Corporations and institutions use Ethereum-based solutions for supply chain tracking, identity management, and tokenization of assets.

Also Read: Ethereum Roadmap: Your Complete Guide to the Future of Web3

Why Ethereum matters in the global economy

Ethereum has transformed how value and information move across the internet. Unlike traditional platforms controlled by corporations, Ethereum enables open, permissionless innovation.

Financial impact

Ethereum has created an entirely new financial ecosystem. The total value locked in DeFi protocols has reached tens of billions of dollars at various points, showing real economic activity on the blockchain.

Ethereum also plays a key role in tokenization. Real-world assets such as real estate, stocks, bonds, and commodities can be represented as digital tokens on Ethereum.

Related: Ethereum vs Solana: Which Blockchain Wins in 2026?

Technological impact

Ethereum introduced the concept of programmable money and decentralized computing. It inspired the development of thousands of blockchain projects and alternative networks such as Solana, Polygon, Avalanche, and others.

Layer 2 solutions built on Ethereum aim to improve speed and reduce costs while maintaining security. Examples include Arbitrum, Optimism, and zkSync.

Social and cultural impact

Ethereum has influenced digital culture through NFTs, DAOs, and Web3 communities. Artists, developers, and creators can monetize their work without traditional intermediaries.

Challenges and limitations

Despite its strengths, Ethereum faces challenges.

Scalability

High transaction demand can lead to network congestion and high fees.

Complexity

Building on Ethereum requires technical expertise, which can limit adoption.

Security risks

Smart contract vulnerabilities and hacks have caused significant losses in the past.

Regulatory uncertainty

Governments worldwide are still defining rules for blockchain and cryptocurrencies.

Ethereum developers are continuously working on upgrades to address these issues, including sharding, Layer 2 scaling, and protocol improvements.

Ethereum vs Bitcoin

Ethereum and Bitcoin are often compared, but they serve different purposes.

Bitcoin focuses on being a decentralized store of value and digital currency.

Ethereum focuses on being a programmable blockchain platform.

Bitcoin has a fixed supply of 21 million coins.

Ethereum does not have a strict fixed supply but uses mechanisms like burning fees to manage issuance.

Bitcoin prioritizes security and simplicity.

Ethereum prioritizes flexibility and innovation.

Both networks coexist and play important roles in the crypto ecosystem.

Bitcoin vs Ethereum: Key Differences

| Parameter | Bitcoin | Ethereum |

|---|---|---|

| Purpose | Digital currency and store of value | Decentralized blockchain platform for smart contracts and applications |

| Technology | Blockchain focused on peer-to-peer transactions | Blockchain with programmable smart contracts and decentralized computing |

| Consensus | Proof of Work (PoW) | Proof of Stake (PoS) after the Merge |

| Use Cases | Digital money, payments, store of value, hedge against inflation | Smart contracts, DeFi, NFTs, dApps, DAOs, tokenization, Web3 |

| Supply Model | Fixed supply of 21 million BTC | No fixed cap, but deflationary mechanisms like fee burning |

| Development Ecosystem | Limited scripting, focused on security and stability | Large developer ecosystem with thousands of dApps and protocols |

Ethereum vs Solana: Which Blockchain Wins in 2026?

Future of Ethereum

Ethereum’s roadmap focuses on scalability, usability, and decentralization.

Layer 2 expansion

More transactions will move to Layer 2 networks, reducing costs and improving speed.

Institutional adoption

Financial institutions are exploring Ethereum for tokenized assets and blockchain-based financial products.

Web3 growth

Ethereum remains central to the development of decentralized internet applications.

Regulatory clarity

Clearer regulations could accelerate mainstream adoption.

The long-term value of Ethereum depends on its ability to maintain security while scaling to billions of users.

Conclusion

Ethereum is more than a cryptocurrency. It is a global decentralized infrastructure that enables programmable money, digital assets, and open financial systems. From smart contracts to DeFi and NFTs, Ethereum has reshaped how technology and finance intersect.

Understanding what Ethereum is helps explain the broader transformation happening in the digital economy. As blockchain adoption grows, Ethereum will likely remain one of the most important platforms in the Web3 era.

Read Also: Bitcoin ETF Explained: How It Works, Why It Matters, and Its Impact on Crypto Markets