Strategy (formerly MicroStrategy), led by Michael Saylor, announced the creation of a US-dollar reserve worth $1.44 billion to cover dividends and interest obligations. The reserve was funded through the sale of Class A common stock under its at-the-market (ATM) program.

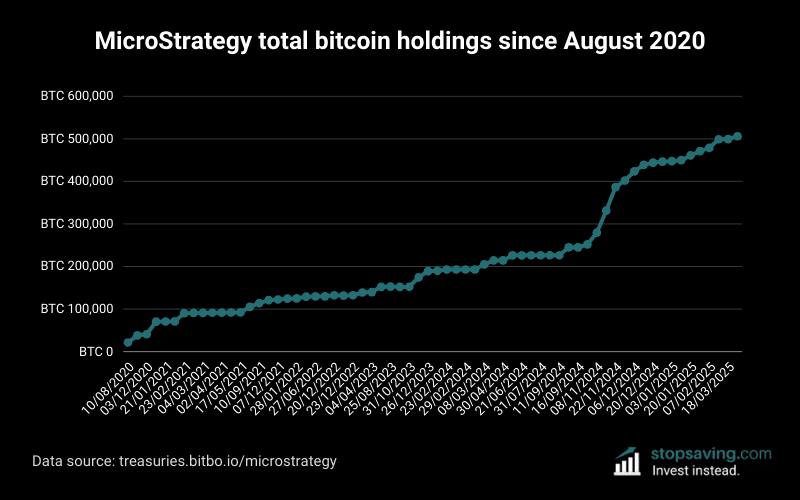

According to the update, the firm also added another 130 BTC (≈ $11.7 million) to its treasury, raising its total holdings to 650,000 BTC, acquired for roughly $48.38 billion.

Management said the USD reserve will serve as the primary source for dividends on preferred stock, debt servicing, and common equity payouts.

The reserve amounts to about 2.2% of Strategy’s enterprise value, 2.8% of its equity value, and 2.4% of its Bitcoin-asset value.

What this means for investors

Strategy said the reserve is meant to improve the quality and appeal of its securities — preferreds, debt, and common equity — by providing liquidity independent of Bitcoin’s short-term volatility.

The company also lowered its 2025 key performance indicators. It now expects Bitcoin yield for the year to land between 22%–26%, projecting year-end BTC price in the $85,000–$110,000 range.

In addition, Strategy trimmed its previous expectation of generating $20 billion in BTC-linked gains this year to an $8.4 billion–$12.8 billion range. Estimated operating income was cut from about $34 billion to a new range of $7 billion–$9.5 billion.

That said, holding 650,000 BTC still positions Strategy as the largest publicly traded Bitcoin holder globally — roughly 3.1% of the 21 million BTC that will ever exist.

What to watch next

The newly established USD reserve provides a buffer against short-term market swings. But BTC remains central to Strategy’s business model. If Bitcoin plunges sharply or liquidity tightens, the firm’s long-term dividend sustainability and growth could come under pressure.

Investors will be watching:

- Bitcoin price trajectory through 2025 and beyond

- Strategy’s ability to sustain dividend payments from its reserve without dipping into BTC holdings

- Whether further equity or debt issuance will be needed if BTC yields underperform

Read Also: China Tightens Crypto Crackdown, Flags Stablecoin Risk