In a new development, Yorkville Acquisition Corp. (SPAC) has named veteran crypto-mining executives Steve Gutterman and Sim Salzman to head its upcoming publicly traded digital-asset treasury firm — a collaboration among Trump Media & Technology Group, Crypto.com and Yorkville. The special-purpose acquisition company expects the merger to close in the first quarter of 2026, unveiling the new firm that will focus on accumulating and staking CRO, the native token of the Cronos blockchain.

New leadership for CRO-treasury push

Yorkville’s decision to appoint Steve Gutterman as CEO and Sim Salzman as CFO at the yet-to-be-named firm signals a strategic emphasis on institutional-grade crypto-treasury operations. Both previously managed senior roles at Gryphon Digital Mining, steering the company through restructuring, regulatory reporting, and capital-market transactions.

Once operational, the new entity will work as follows: it will acquire CRO tokens as its core reserve asset; operate a validator node on Cronos; stake the holdings to generate yield; and manage the treasury actively, aiming for long-term value accumulation.

The firm’s genesis lies in a business-combination agreement between Trump Media, Crypto.com and Yorkville, announced earlier in 2025. Under that agreement, the treasury will begin with $1 billion in CRO tokens, along with cash, warrants and a sizable equity credit line — making it the largest publicly traded CRO-focused treasury vehicle to date.

Implications for CRO and the crypto-treasury trend

This move cements the “crypto-treasury” model — popularized earlier by other firms via Bitcoin or Ethereum — but now expanded to CRO. By putting native tokens on balance sheets and staking them, such entities aim to capture potential long-term upside while earning staking yields.

For CRO, this could mean increased demand and upward pressure on price, given a large, institutional holder and reduced circulating supply. On the flip side, seasoned investors will watch closely: digital-asset treasuries remain vulnerable to market swings, especially in volatile crypto cycles.

At the broader level, the success or failure of this venture will influence whether more companies consider native-token treasuries over traditional holdings — pushing the institutionalization of altcoins beyond just Bitcoin or Ethereum.

Conclusion

With experienced crypto executives at the helm and a well-capitalized structure, the Trump Media–Crypto.com collaboration via Yorkville aims to scale CRO accumulation and staking. The result could reshape how altcoin treasuries are viewed — and position CRO as a serious corporate reserve asset.

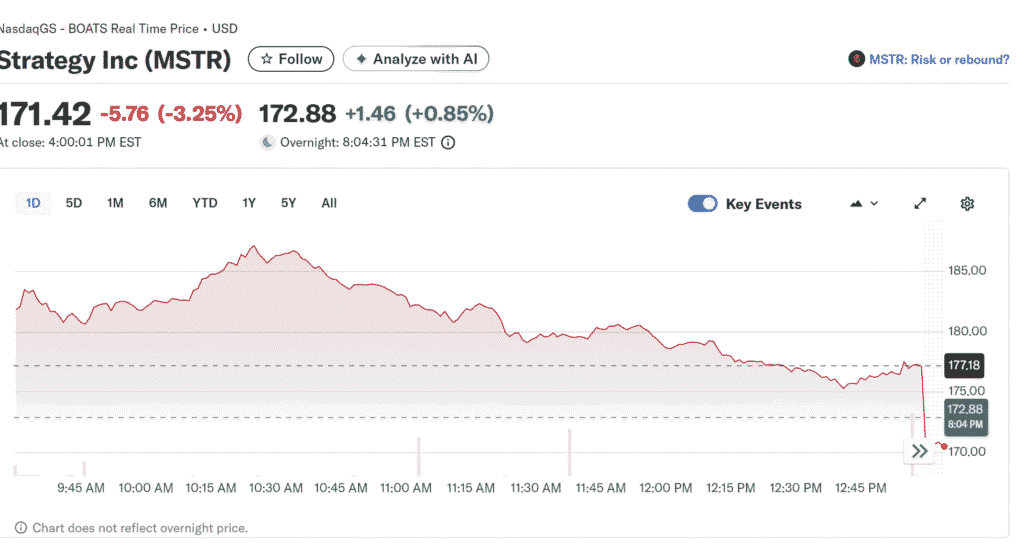

Read Also: Strategy expands BTC holdings and builds cash buffer