According to a recent regulatory move, the U.S. Securities and Exchange Commission (SEC) has issued official warning letters to several ETF issuers, effectively pausing new applications for highly leveraged ETFs that aim for more than 200 percent exposure to underlying assets. This decisive step signals mounting scrutiny over risk controls in the leveraged-fund space, particularly in crypto and equities.

What the warning letters mean

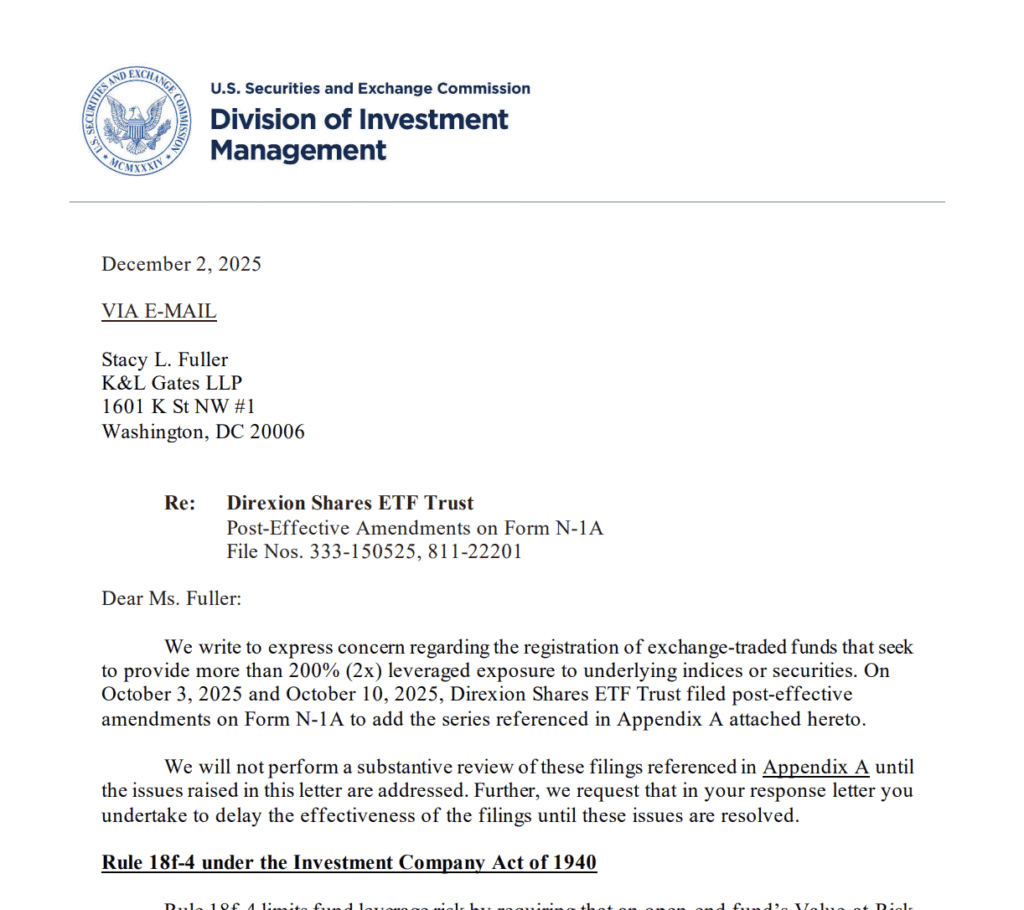

The SEC’s letters went to prominent issuers including Direxion, ProShares and Tidal Financial — among others — that filed for ETFs proposing extreme leverage, such as 3× or even 5× daily exposure. Regulators cited existing law under the Investment Company Act of 1940, which caps a fund’s value-at-risk relative to its unleveraged reference portfolio, expressing concern these products may breach acceptable risk thresholds.

The letters demand that issuers either revise their leverage strategies to align with regulatory limits or withdraw their applications. Until compliance is confirmed, the SEC will not proceed with review or approval of these high-leverage funds. Market analysts say the move may effectively block most 3×–5× crypto and equity ETFs from launching — at least until clearer regulations or risk frameworks are established.

Implications for investors and the crypto market

This regulatory crackdown underscores the hazards of leveraged ETFs, especially in volatile markets like crypto. While such products promise amplified returns, they carry heightened risk: any sharp asset-price moves may result in steep losses for holders. For many investors, this could prompt a shift toward traditional funds or spot holdings to reduce leverage-driven exposure.

Exchanges and asset managers seeking to offer aggressive leveraged products must now reassess their risk models and compliance approaches. The ruling may also dampen speculative ETF launches for the time being, favoring more conservative or regulated crypto investment strategies.

In a broader sense, the action reflects growing regulatory discipline in the U.S. financial system regarding crypto-related instruments — a sign that regulators are prepared to intervene where leverage and risk may threaten market stability or investor protection.

Conclusion

By issuing the warning letters, the SEC has drawn a firm line on leverage limits — and made clear that “untamed leverage” will not be tolerated. For the crypto industry and ETF issuers, this represents a wake-up call to prioritize compliance and risk control. The decision could reshape how leveraged crypto products are structured and offered in the U.S., at least for the foreseeable future.

Read Also: Georgia explores blockchain for land registry as push for on chain property rights advances