Circle, the publicly listed issuer behind USD Coin (USDC), has entered a new strategic partnership with Bybit to expand liquidity, improve stablecoin access and strengthen compliance across the exchange’s global ecosystem. The companies announced the collaboration as USDC’s market capitalization climbs toward its highest level, now nearing 80 billion dollars.

According to both firms, the partnership is designed to make USDC more widely available across trading, settlement and payment channels. Circle highlighted that regulatory alignment will play an important role as the stablecoin issuer expands its presence in key regions.

Bybit expands USDC integration

A spokesperson for Bybit told Cointelegraph that the exchange plans to deepen USDC integration across spot markets, derivatives and payment channels. The focus is on improving liquidity, building stronger fiat on and off ramps and expanding crosschain support.

Bybit said the collaboration strengthens the underlying stablecoin infrastructure already built over the past several years. The exchange integrated USDC into trading pairs, savings products, institutional settlement tools and conversion features before the new partnership was established.

The spokesperson added that the partnership will be especially important in the European Economic Area, where Circle operates under MiCA authorization. Bybit expects the region to be a major driver of stablecoin use cases and onchain settlement.

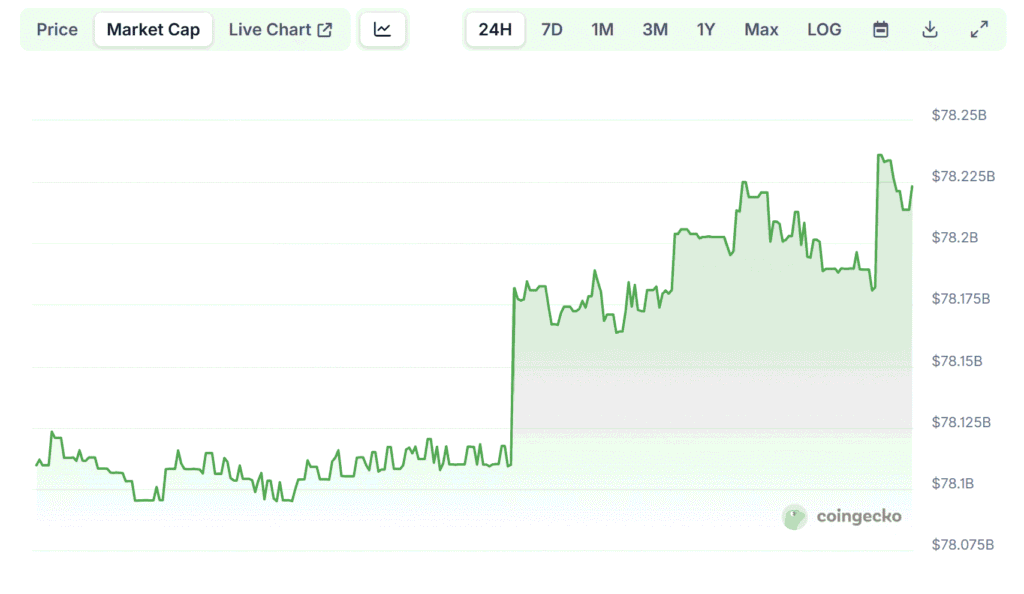

USDC supply nearing 80 billion

USDC has recorded one of its strongest growth periods since early 2025. Data from CoinGecko shows that USDC’s market cap has surged 77 percent since January 1, rising from about 44 billion dollars to roughly 78 billion dollars as of this week.

Circle has accelerated partnerships in traditional finance as part of this expansion. Its collaborations include Deutsche Börse for digital asset market infrastructure and Mastercard for payment integrations.

By comparison, Tether’s USDT supply has grown from 137 billion dollars to about 186 billion dollars in 2025, an increase of around 36 percent.

A Bybit spokesperson emphasized that the partnership with Circle is not exclusive. The exchange continues to support multiple stablecoins and intends to maintain user choice. The priority is transparency, stronger regulation and reliable settlement channels as the digital asset industry matures.

Conclusion

The new partnership positions Bybit to expand USDC usage across its trading and settlement ecosystem while Circle gains a larger role in regulated stablecoin infrastructure worldwide. With USDC approaching an 80 billion dollar market cap, the collaboration arrives during a period of accelerating stablecoin adoption and broader integration between crypto exchanges and traditional financial institutions.

Read Also: South Korea moves to impose bank-level liability on crypto exchanges after Upbit breach