Memecoins may have fallen out of favor in recent months, but the sector is far from finished. According to MoonPay president Keith A. Grossman, memecoins are not dead. Instead, they are likely to re-emerge in a different and more sustainable form as the market matures and learns from past excesses.

Speaking about the broader crypto cycle, Grossman said the decline in memecoin activity should not be mistaken for permanent failure. Rather, it reflects the fading of a short-term narrative after a period of rapid speculation. He argued that the underlying innovation behind memecoins remains intact, particularly their ability to tokenize attention at low cost through blockchain technology.

At its core, Grossman said, the memecoin phenomenon represents a shift in how value is created and distributed online. Before blockchain-based assets, attention was largely monetized by centralized platforms, major brands, and a limited number of influencers. Everyday users contributed likes, trends, inside jokes, and online communities, but received little direct economic benefit in return. Memecoins changed that dynamic by allowing communities themselves to capture and distribute value.

This idea of attention as an asset, Grossman noted, is not new. What is new is the ability for anyone to participate without relying on large intermediaries. That principle, he said, is what will allow memecoins to evolve rather than disappear.

Market fallout and political memecoins accelerated the downturn

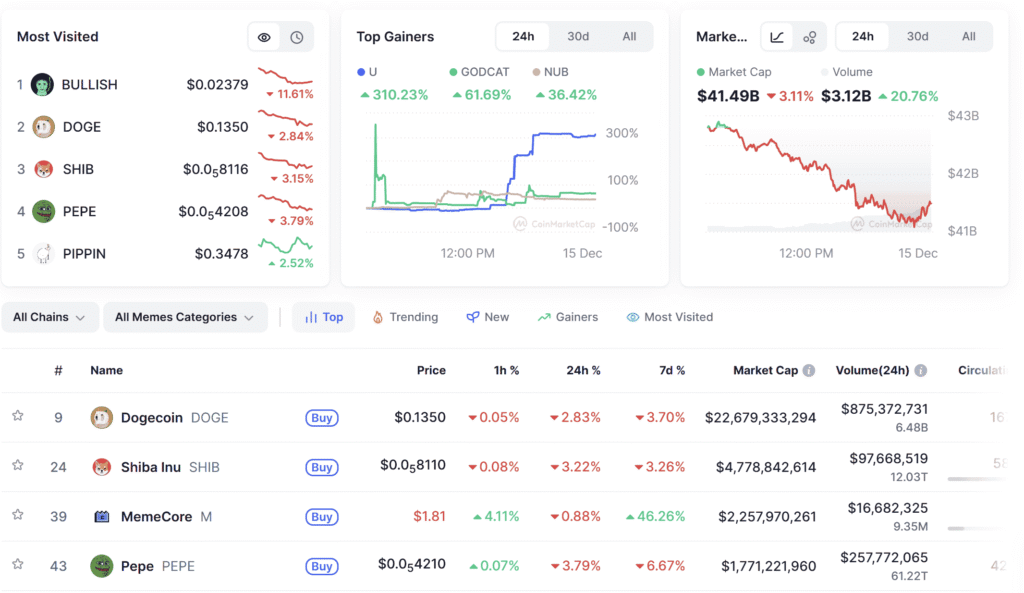

Despite their strong performance in 2024, memecoins faced a sharp reversal in early 2025. Data from CoinGecko previously showed that memecoins were among the best-performing crypto asset categories last year, driven by viral narratives and retail enthusiasm. However, that momentum unraveled quickly following a wave of high-profile collapses.

The downturn intensified in the first quarter of 2025 as several tokens experienced steep drawdowns that were widely described as rug pulls. Political involvement also played a role in damaging investor confidence.

In the United States, President Donald Trump launched a memecoin ahead of his January 2025 inauguration. The token surged to a peak price of $75 before collapsing by more than 90 percent, trading near $5.42 at the time of reporting, according to CoinMarketCap. The dramatic rise and fall became a symbol of the risks associated with hype-driven tokens.

In Argentina, President Javier Milei endorsed a social token called Libra in February. That token also collapsed, leaving 86 percent of holders with realized losses exceeding $1,000. Libra briefly reached a market capitalization of $107 million before its collapse. The fallout triggered lawsuits from retail investors and calls for impeachment, along with a government investigation into Milei’s involvement.

These events reinforced criticism that memecoins lack intrinsic value and are prone to abuse. However, Grossman compared the pessimism surrounding memecoins to early predictions about the death of social media after the collapse of first-generation platforms in the early 2000s. Those failures, he noted, did not prevent a second wave of companies from transforming social media into a dominant cultural and economic force.

Looking ahead, Grossman believes memecoins will return with more utility-driven designs, better-aligned incentives, and stronger community ownership. Rather than pure speculation, future memecoins may focus on governance, creator participation, and transparent value flows. In that sense, the current downturn may serve as a reset rather than an ending for memecoins.

Read Also: Juventus Football Club owner Exor rejects Tether takeover bid