Stablecoin issuer Circle has signed an agreement to acquire the team and proprietary intellectual property of Interop Labs, a key contributor to the Axelar Network. The transaction, expected to close in early 2026, is part of Circle’s broader push to strengthen its blockchain infrastructure and crosschain capabilities.

Under the agreement, Interop Labs’ personnel and technology will be absorbed into Circle’s infrastructure business. The Axelar Network itself, along with its foundation and the AXL token, will remain independent and continue to be governed by its community. Circle said the deal will not alter Axelar’s decentralized governance or token economics.

Interop Labs is the original developer of the Axelar Network, which provides decentralized crosschain messaging and asset transfer capabilities across multiple blockchains. Circle plans to integrate Interop Labs’ technology into its Arc blockchain and its Cross-Chain Transfer Protocol, known as CCTP. According to Circle, this integration is expected to improve interoperability for assets issued on Arc, enhance developer tooling for multichain applications, and support the rollout of Circle-built products.

To ensure continuity for the Axelar ecosystem, another core contributor, Common Prefix, will assume Interop Labs’ previous development responsibilities on the open source network. Circle did not disclose the financial terms of the acquisition.

Circle builds on infrastructure strategy as stablecoin issuers expand through deals

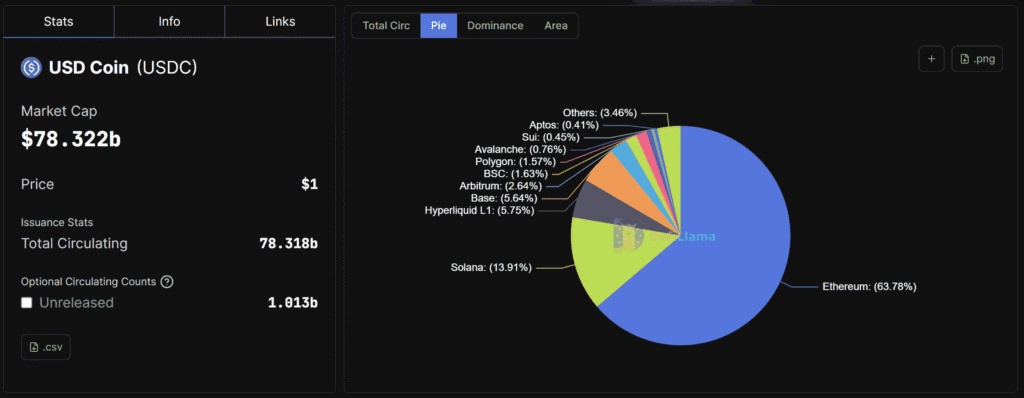

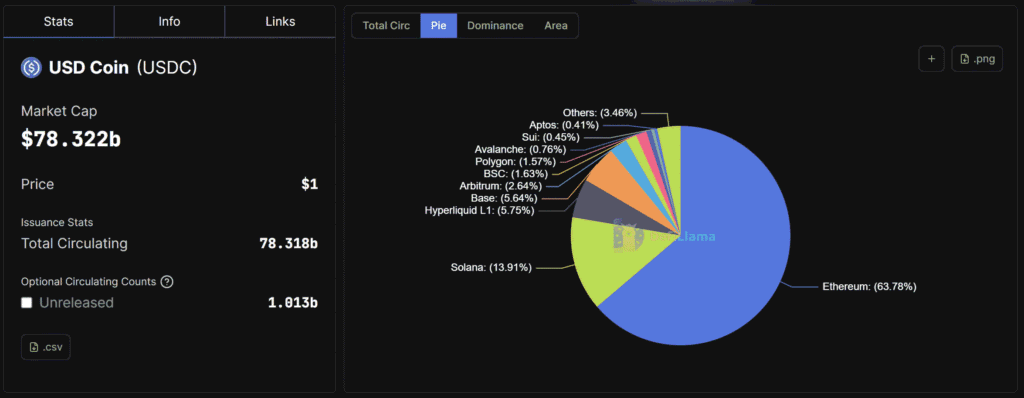

The acquisition adds to Circle’s recent infrastructure focused expansion. Circle is the issuer of USDC, the second largest stablecoin by market capitalization. USDC represents roughly 25 percent of the estimated $310 billion global stablecoin market, based on data from DefiLlama. The company has been positioning itself beyond stablecoin issuance, with growing emphasis on payments, tokenization and blockchain infrastructure.

In January, Circle acquired Hashnote, the issuer of the tokenized money market fund US Yield Coin. That transaction brought one of the largest yield bearing real world asset products into Circle’s stablecoin and infrastructure portfolio. The Interop Labs deal follows a similar pattern, targeting core technical capabilities rather than consumer facing products.

Across the sector, stablecoin issuers have increasingly turned to acquisitions in 2025 to scale operations and diversify revenue. In November, Paxos acquired institutional crypto wallet provider Fordefi in a deal valued at more than $100 million, according to Fortune. Paxos said the acquisition strengthened its custody and transaction infrastructure for stablecoin issuance, asset tokenization and onchain payments.

Tether, the issuer of USDt, has taken a different approach by using its balance sheet to acquire minority stakes across traditional asset businesses. In June, Tether acquired about a 32 percent stake in Canada listed gold royalty firm Elemental Altus Royalties for roughly $89 million. In November, Tether Investments purchased around 11.8 million shares in Versamet Royalties through a private transaction. Tether has also explored expansion into sports, submitting a binding all cash offer in December to acquire a controlling stake in Juventus Football Club, a bid that was later rejected.

For Circle, the Interop Labs acquisition signals a continued focus on interoperability as competition intensifies among blockchain infrastructure providers. As multichain applications become more common, Circle appears to be betting that tighter integration between stablecoins, payments infrastructure and crosschain technology will be critical to long term growth.

Read Also: Moto Edge 70 Launches in India With 50MP Triple Cameras, MIL Grade Durability