According to a recent report from Grayscale Research, the pattern of past cycles suggests that Bitcoin may be poised for a breakout and reach new highs in 2026.

What Grayscale sees in the cycle

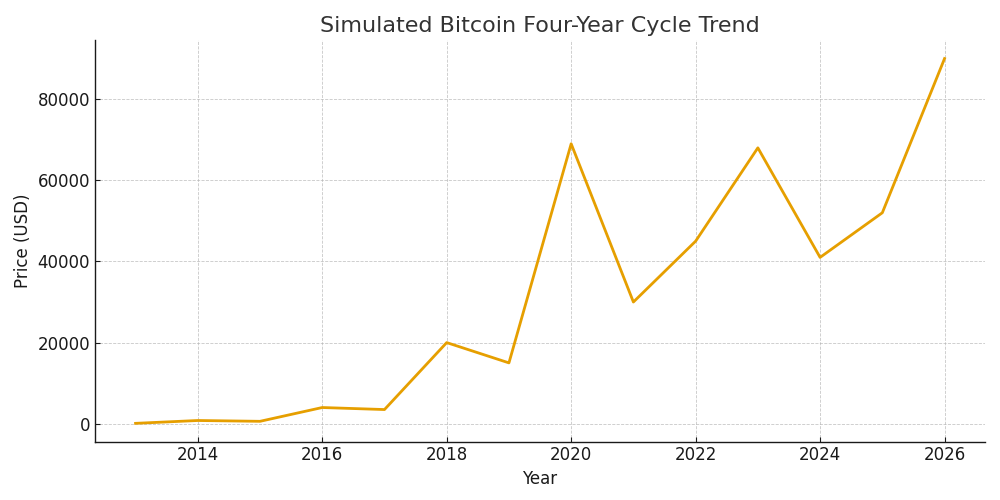

Grayscale’s analysis notes that Bitcoin has historically followed a roughly four-year rhythm tied to halvings and market cycles — each period producing a run-up phase followed by consolidation.

The firm argues that despite recent volatility and structural changes in crypto markets (like ETF adoption and institutional flows), the underlying momentum tied to cycle behavior remains intact.

As of now, Bitcoin appears to be tracking a similar path as previous cycles in terms of price recovery and market renewed interest.

What this could mean for 2026 and investors

If the four-year cycle pattern holds, Bitcoin could set new all-time highs in 2026. That outcome would reflect a rebound from the 2022 low, climb through market stabilization, and renewed institutional and retail demand.

This potential resurgence may also benefit related crypto-investment products, such as ETFs and institutional holdings, enhancing market liquidity and possibly reducing volatility compared with previous cycles.

Conclusion

Grayscale’s outlook reinforces the view that the Bitcoin four-year cycle may still be relevant — and that 2026 could be the year Bitcoin reaches new peaks. For investors watching long-term trends, this cycle-based narrative offers a lens to evaluate potential upside while remaining aware of structural changes in the crypto market.

Read Also: Blockchain could help modern science extend human healthspan, report says