The latest data shows that IBIT, the flagship spot-Bitcoin ETF from BlackRock, suffered heavy net outflows totaling US$ 2.34 billion during November 2025. Still, BlackRock business-development director Cristiano Castro described the redemptions as “perfectly normal,” emphasizing that such movements reflect cash-flow management rather than a loss of long-term confidence.

Despite the rough month, Castro reinforced that IBIT and BlackRock’s crypto ETFs remain among the firm’s strongest revenue drivers — a status made possible by an earlier surge that brought combined U.S. and Brazil IBIT listings “very close to $100 billion” in assets at peak.

What Happened

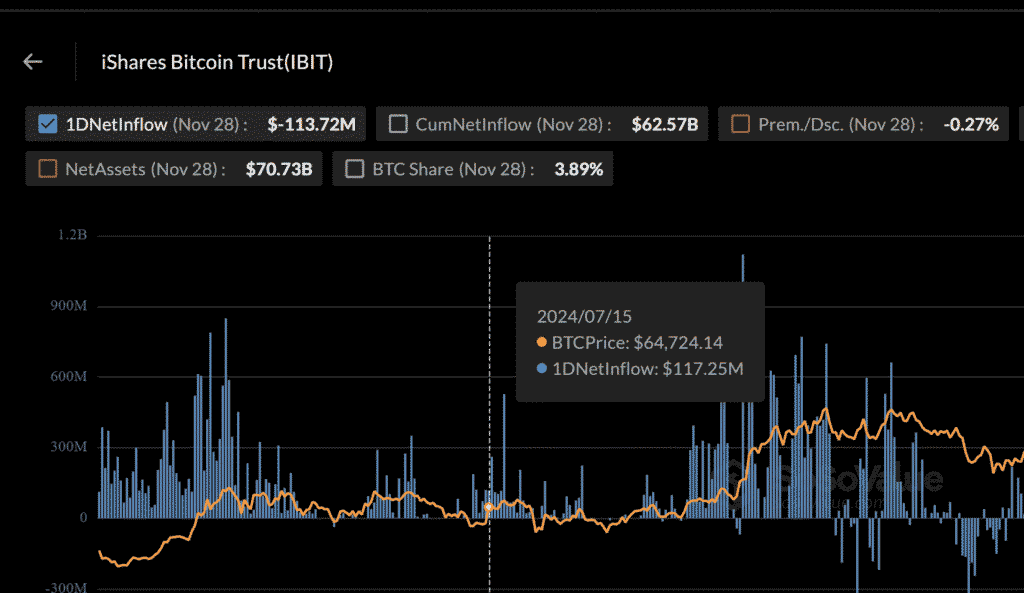

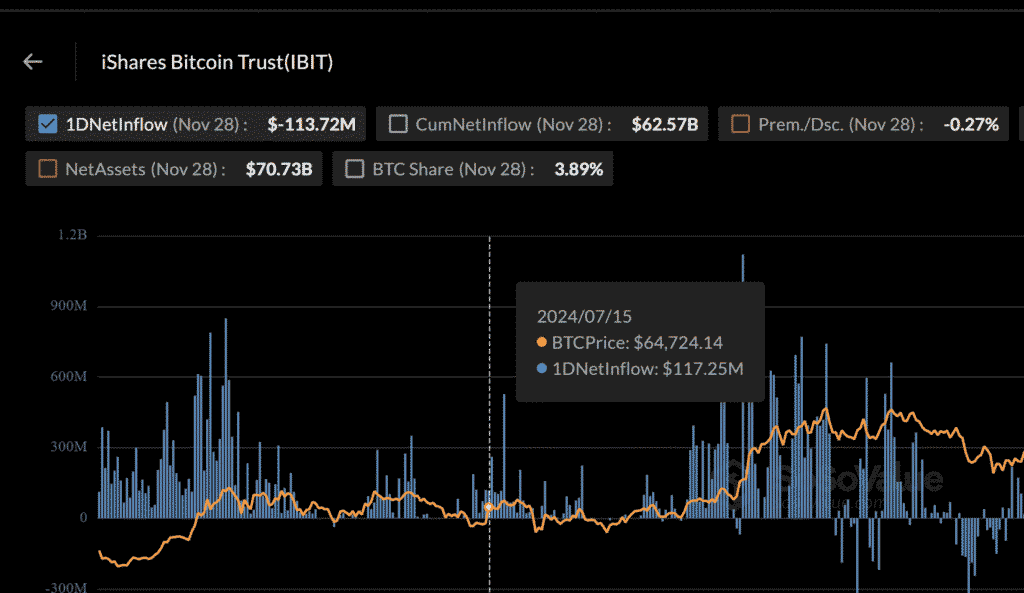

According to fund-flow trackers, November saw IBIT exit net $2.34 billion in capital. Two of the largest single-day withdrawals occurred mid-month: roughly $523 million on November 18 and about $463 million on November 14.

BlackRock highlighted that ETFs—particularly those with a large proportion of retail investors—are inherently liquid and subject to periodic outflows as investors react to price swings or rebalance portfolios. Castro said November’s withdrawals are a standard part of ETF lifecycle during periods of price compression.

Still, the fund’s long-term holders may be breathing easier after recent price action. As Bitcoin climbed back above US$ 90,000, cumulative gains across IBIT reportedly reached about US$ 3.2 billion — largely reversing earlier losses tied to the market drawdown.

In a broader context, some spot-crypto ETFs ended a four-week outflow streak with positive flows last week — a sign that the worst of the unwind might be over.

Why This Matters (And What Investors Should Note)

For long-term investors and crypto watchers, this episode underscores the volatile nature of crypto-ETFs. High liquidity means rapid inflows — but also swift outflows when sentiment shifts. While outflows may seem alarming at first glance, BlackRock’s response suggests that large swings are part of normal capital-rotation dynamics, not necessarily a death knell for confidence in BTC ETFs.

In addition, IBIT’s scale — once nearing $100 billion — illustrates how much institutional and retail demand surged this cycle. That “scale + liquidity + flexibility” is exactly what ETFs offer, but it comes with the trade-off of sensitivity to market corrections.

Still, the rebound in Bitcoin’s price and early signs of inflows returning hint that November’s outflows may represent a momentary pause in a long-term growth story — especially if price stability holds and macro conditions soften.

Read Also: Arthur Hayes Warns Monad Could Crash 99% — High-Risk “VC Coin” Alert