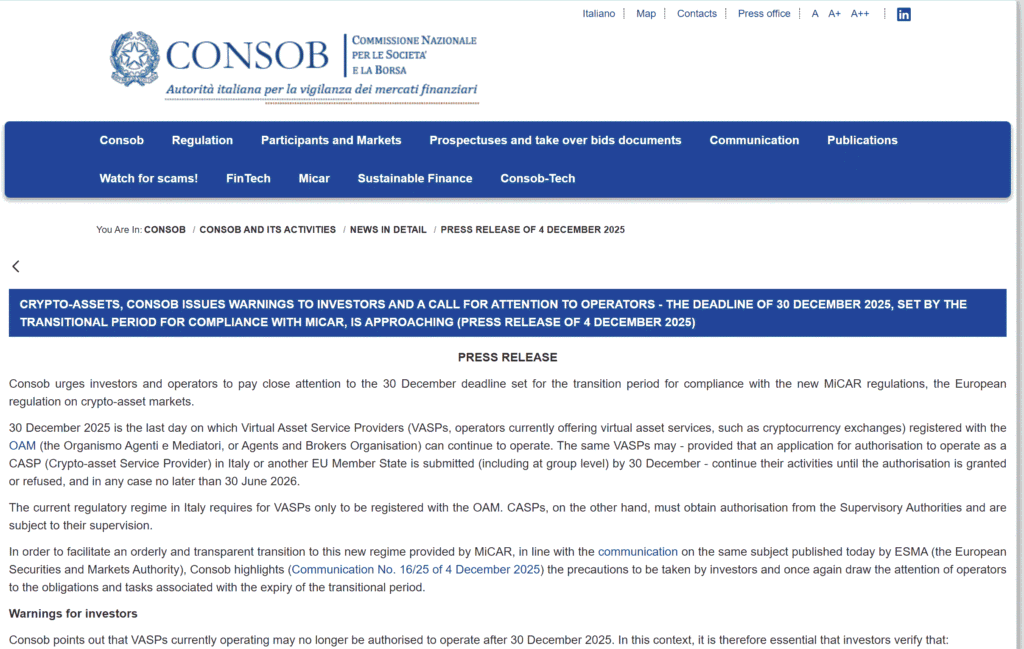

Recent regulatory updates from CONSOB, Italy’s financial markets regulator, confirm that the upcoming Markets in Crypto‑Assets Regulation (MiCA) deadline for crypto virtual asset service providers (VASPs) in Italy will be strictly enforced — signaling a new phase of compliance for exchanges, custodians, and other crypto firms operating in the country.

What the MiCA deadline means for Italian crypto firms

Under the new MiCA compliance timeline, all VASPs operating within Italy — including exchanges, custodians, token issuers, and other related services — must register with CONSOB and meet the regulatory requirements set out under MiCA. This includes robust customer-protection rules, compliance with anti-money-laundering (AML) obligations, transparent disclosures, and strong governance standards. Firms that fail to meet registration and compliance requirements by the MiCA deadline risk being barred from legally providing crypto services in Italy.

Regulators have highlighted that the MiCA deadline will apply across the board, affecting domestic firms and also international entities serving Italian customers. The regulation aims to bring uniformity and legal clarity to crypto-asset services across Europe, and Italy’s strict enforcement signals its commitment to regulating the sector.

Impact on the market and investors

For crypto exchanges and custodians operating in Italy, the MiCA deadline represents both risk and opportunity. Firms that comply may benefit from greater credibility, regulatory clarity, and access to a broader consumer base seeking regulated services. On the other hand, firms unwilling or unable to comply may exit the Italian market, reducing supply — which could lead to consolidation among compliant players.

For retail and institutional investors, the stricter regulatory framework may provide enhanced safety. Registered VASPs will need to adhere to AML rules, maintain transparent operations, and provide clear disclosures, which may reduce fraud, mismanagement, or opaque practices. This regulatory oversight could help stabilize the Italian crypto market and boost long-term trust.

Conclusion

The looming MiCA deadline underlines that crypto firms in Italy must act quickly to comply. With CONSOB signaling robust enforcement, unregistered or non-compliant VASPs risk exclusion from the legal market. The renewed focus on regulation may lead to a safer and more stable environment for crypto investors in Italy — but also reduce the number of available platforms in the near term.

Read Also: Bitwise CIO confirms Strategy will hold Bitcoin despite stock volatility