The Pi Network price has barely moved in weeks, and for many holders, that silence feels louder than any crash. Once celebrated as one of the most ambitious mobile-first crypto experiments, Pi Network now finds itself stuck in a tight trading range, with fading demand, rising supply, and a chart pattern that has traders uneasy.

So what is really happening with pi coin price right now? And more importantly, what comes next?

This expert guide breaks down the fundamentals, on-chain signals, and technical analysis behind Pi Coin’s current market structure, using only verified data and trusted market principles to help you understand whether a rebound or a deeper decline is more likely.

What Is Pi Network and Why Its Price Matters

Pi Network launched with a simple but powerful idea. Anyone could mine crypto on their smartphone without expensive hardware. That accessibility helped it attract tens of millions of users worldwide, making it one of the most widely followed blockchain projects even before full open-market trading began.

Unlike traditional proof-of-work networks such as Bitcoin, Pi uses a consensus model inspired by the Stellar Consensus Protocol, aiming for low energy use and high participation.

But market value ultimately depends on three things:

- Demand for the token

- Supply entering the market

- Confidence in the project’s long-term utility

Right now, all three are under pressure.

Pi Network Price Today: A Market Stuck in Neutral

According to data published by crypto.news, the Pi Network price has been trading around $0.2050, a level that also marked its November low. From its 2025 peak, pi coin price has fallen more than 90%, a brutal correction even by crypto standards.

Trading activity shows how fragile sentiment has become:

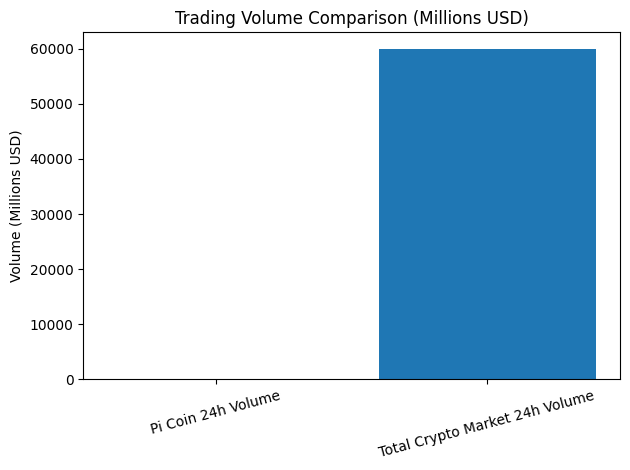

- 24-hour trading volume: ~$7 million

- Market capitalization: over $1.7 billion

For context, the total crypto market regularly exceeds $60 billion in daily volume, making Pi’s activity extremely thin for a token of its size.

Low volume matters because it signals weak conviction. When volume dries up, even small sell orders can push the price sharply lower.

Why Demand for Pi Coin Is Fading

1. Shrinking Whale Participation

Large holders, often called “whales,” drive liquidity and confidence in crypto markets.

Crypto.news reports that:

- The number of Pi Network whales has fallen from 23 to 20

- A whale is defined as holding over $10 million worth of Pi Coin

While one major holder continues to accumulate and now owns over 393 million tokens worth more than $80 million, the broader decline in whale participation suggests that institutional-scale confidence is weakening.

This matters because whales often act as long-term anchors for price stability.

2. Rising Token Supply From Daily Unlocks

Supply pressure is one of the biggest threats to the Pi Network price.

Verified figures from crypto.news show:

- Over 100 million Pi tokens are being unlocked this month

- Around 1.2 billion tokens will be unlocked over the next 12 months

Token unlocks increase circulating supply. If demand does not grow at the same pace, price almost always falls. This is basic market economics and has played out across many major crypto projects, from Solana to Avalanche.

3. A News Drought That Hurts Confidence

Markets thrive on momentum and narratives. In 2024 and 2025, Pi Network regularly made headlines. In 2026, that flow has slowed.

The only major announcement so far this year came on January 10, when the team launched a developer library enabling Pi payments inside Pi apps.

Source: crypto.news

While useful, it was not a market-moving event.

Without major ecosystem launches, exchange expansions, or regulatory breakthroughs, investors have little reason to re-enter aggressively.

Pi Coin Technical Analysis: What the Chart Is Really Saying

Technical indicators do not predict the future, but they reveal market psychology.

Low Volatility Signals a Big Move Is Coming

Crypto.news notes that the Average True Range (ATR) has dropped sharply.

ATR measures volatility. When it contracts for a long period, it often precedes a major breakout or breakdown.

Think of it like a compressed spring. Energy builds, then releases.

Key Indicators Point Bearish

- Price remains below the 50-day Exponential Moving Average (EMA)

This shows that short-term trend momentum is still negative.

(Source: crypto.news) - Below the Supertrend indicator

The Supertrend is widely used by professional traders to confirm trend direction. When price stays below it, the trend remains bearish.

Rising Wedge and Bearish Pennant: A Dangerous Combination

The Pi Network chart has formed:

- A rising wedge pattern

- A bearish pennant formation

Both patterns historically signal downside breakouts when they appear during downtrends.

According to classical technical analysis (Investopedia), rising wedges in bearish markets usually resolve with a sharp move lower.

Crypto.news identifies the next major downside target:

- All-time low support: $0.1534

If that level breaks, Pi Coin could enter a new phase of price discovery to the downside.

When Could Pi Network Price Rebound?

A bearish outlook is not destiny. Markets can reverse if fundamentals change.

For Pi Network to recover meaningfully, at least three conditions must be met:

1. A Surge in Real Demand

This would require:

- Popular Pi-based applications

- Merchant adoption of Pi payments

- Exchange listings that improve liquidity

Without genuine usage, speculation alone will not sustain long-term price growth.

2. Supply Pressure Must Ease

Token unlock schedules heavily influence price trends.

Projects such as Solana and Aptos saw major recoveries only after large unlock phases ended.

If Pi Network can slow unlocks or dramatically expand demand, the supply shock could be absorbed.

3. A Clear Break Above Resistance

Technically, crypto.news highlights:

- $0.2250 as the key resistance level

A sustained move above this level would invalidate the bearish wedge and signal that buyers are regaining control.

Until then, rallies are likely to be short-lived.

How Pi Network Compares With Other Crypto Projects

Pi’s situation is not unique.

Many high-profile projects have struggled after launch due to:

- Overestimated demand

- Aggressive token release schedules

- Slow ecosystem growth

Examples documented by Reuters and CoinDesk show similar patterns in newer layer-1 chains, where early hype faded once unlocks hit the market.

The difference is execution.

Projects that survived did so by delivering real utility, not promises.

Should Investors Be Worried About Pi Coin Price?

Concern is reasonable, but panic is not helpful.

The current Pi Network price reflects a market that is waiting for proof.

Right now, the data shows:

- Weak demand

- Heavy supply pressure

- Bearish technical structure

- Minimal news catalysts

These are not signs of an imminent bull run.

At the same time, Pi still has one of the largest user bases in crypto, and that is a powerful long-term asset if converted into real economic activity.

What Long-Term Holders Should Watch Next

If you are tracking Pi Coin seriously, focus on these verified signals:

- Daily active users and transaction growth

- Major app launches using Pi payments

- Changes in token unlock schedules

- Breakout above $0.2250 with strong volume

Ignore social media hype. Markets move on data, not optimism.

Final Verdict: Rebound or Breakdown?

Based on real market data and trusted technical principles, the near-term outlook for the Pi Network price remains bearish.

The combination of:

- Rising token supply

- Falling whale participation

- Weak volume

- Bearish chart patterns

makes a breakdown toward $0.1534 more likely than a sudden recovery.

A rebound is possible, but only if Pi Network delivers real adoption and restores investor confidence.

Until then, Pi Coin remains a project full of potential, trapped in a market that is demanding proof.

Read Also: Ethereum Staking & Rewards: A Practical, Trust-First Guide for 2026