US regulators at the Securities and Exchange Commission held a closed door roundtable with cryptocurrency industry leaders on Monday to examine how financial surveillance and user privacy should be handled as digital asset adoption grows. The discussion forms part of the SEC’s broader effort to reassess its oversight approach at a time when blockchain based financial activity is expanding rapidly.

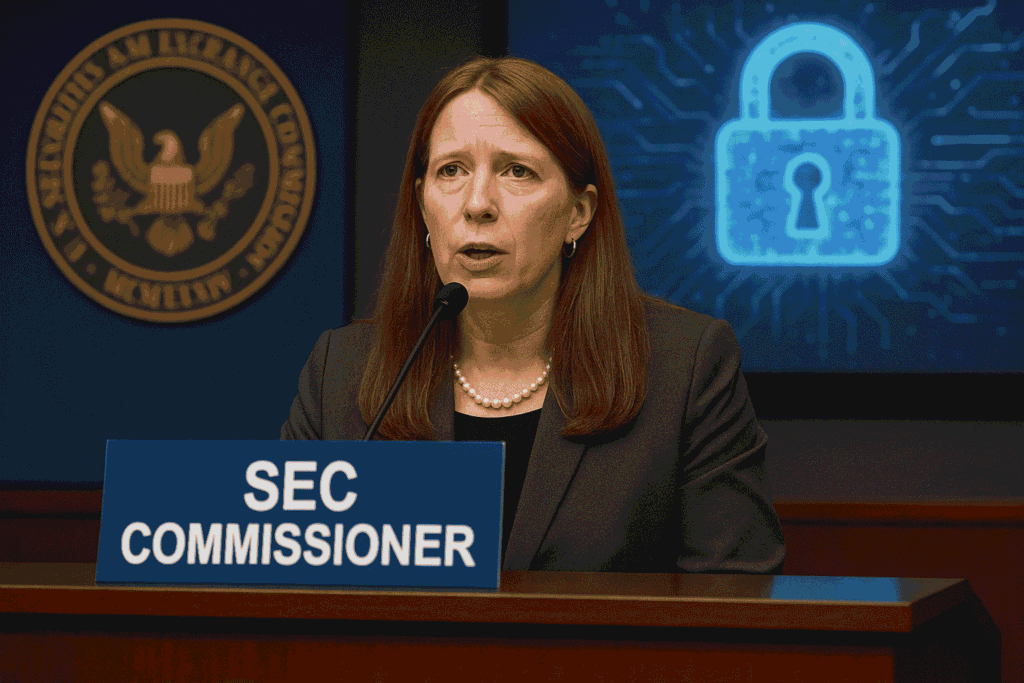

In opening remarks, SEC commissioner Hester Peirce, who leads the agency’s crypto task force, joined SEC Chair Paul Atkins and Commissioner Mark Uyeda in outlining the challenge of protecting investors without undermining financial privacy. Officials acknowledged that public blockchains present both transparency benefits and new risks related to surveillance.

Atkins warned that crypto could become what he described as the most powerful financial surveillance architecture ever created, depending on regulatory choices made by US authorities. He pointed to earlier regulatory approaches that treated every crypto wallet like a broker, which increased reporting requirements and expanded data collection. According to Atkins, those policies risked pushing the financial system toward excessive monitoring rather than balanced oversight.

Peirce echoed those concerns, arguing that regulators need to reconsider when and how financial transactions are monitored as crypto markets mature. She said the existing framework for financial surveillance has grown far beyond its original intent and that digital assets are forcing regulators to confront those realities. Peirce noted that crypto enables transactions without traditional intermediaries, which challenges assumptions built into the current regulatory model.

At the same time, she acknowledged that most crypto transactions occur on public blockchains that are visible to anyone, creating demand for privacy enhancing tools. Peirce said this tension between transparency and privacy must be addressed carefully to avoid discouraging innovation while still protecting investors and market integrity.

SEC commissioner discussions coincide with market structure debate in Congress

The privacy focused roundtable included representatives from Zcash, the Blockchain Association and the Crypto Council for Innovation. It marked the sixth public policy discussion hosted by the crypto task force since Peirce launched the group in January. Industry participants have increasingly raised concerns that expanding surveillance could undermine legitimate uses of blockchain technology, particularly as regulators and courts work to define clear rules for the sector.

The timing of the meeting is notable as US lawmakers face mounting pressure to pass comprehensive digital asset market structure legislation before 2026. With the expected departure of SEC Commissioner Caroline Crenshaw, momentum behind regulatory reform has taken on added urgency. Early drafts of proposed legislation suggest a shift in authority toward the Commodity Futures Trading Commission, potentially reducing the SEC’s role in overseeing certain crypto markets.

A market structure bill known as the CLARITY Act passed the House of Representatives in July. Since then, members of the US Senate have been negotiating to bring the bill to a floor vote before the end of the year. As of Monday, that effort appeared unlikely to succeed within the current legislative window, raising questions about regulatory clarity heading into 2026.

For the SEC, the roundtable underscores an internal debate about how far financial surveillance should extend in an era of programmable money and decentralized networks. Statements from more than one SEC commissioner suggest that future policy may place greater emphasis on privacy preserving compliance rather than broad reporting mandates. How that balance is struck could shape the next phase of US crypto regulation.

Read Also: Kali Linux 2025.4 released with new hacking tools and desktop upgrades